Business Legal

Health & Safety – What every business needs to know

After the Lisbon building fire tragedy in Johannesburg a lot of businesses have found themselves under scrutiny for not complying with the health and safety standards. These standards are as applicable to small business owners’ as they are to big ones. If you own a small business here is what you need to know.

What is occupational health and safety about?

It is about preventing people from being harmed by work or falling ill as a result of work by taking precautions and providing a satisfactory working environment.

What possible risks and injuries can be sustained at the workplace?

There are a number of risks that can be found at work. The following are a few examples of possible risks: Slipping or tripping at work, chemicals, falling from heights etc. The employer or self-employed person has the responsibility to ensure that no person is injured or affected by activities taking place at the workplace. Workers at the workplace must also make sure that no person is harmed because of their negligence or simple lack of cooperation with the employer.

How is the health and safety of the people protected?

There are rules which require all of us not to put ourselves or others in danger. The law is also there to protect the public from workplace dangers. According to the labour guide The Occupational Health and Safety Act, 1993, requires the employer to bring about and maintain, as far as reasonably practicable, a work environment that is safe and without risk to the health of the workers.

What should be done if an injury has occurred at work?

The employer or self-employed person should report incidents to the Department of Labour. The incidents should be reported immediately, especially if they are serious, or within seven days.

Furthermore in the event that an employee has been injured, disabled or has died as a result of a work incident the Compensation for Occupational Injuries and Diseases Act (COIDA) applies. COIDA provides for compensation for disablement caused by occupational injuries or diseases sustained or contracted by employees in the course of their employment, or for death resulting from such injuries or diseases; and to other matters connected therewith.

Who is responsible for the development and enforcement of health and safety laws?

The Department of Labour is responsible for the development of health and safety laws in South Africa and the enforcement thereof. The Department appoints Inspectors whose function it is to enforce the health and safety laws. They visit workplaces and check that people are sticking to the rules. They investigate incidents and complaints. They also help you understand what you need to do. They will usually fine the employer when there is serious violation of rules.

Do health and safety laws apply to small businesses?

Yes, health and safety laws apply to all businesses no matter how small.

Tips:

- If you are unsure of what you need to do speak to the department of labour or have your legal provider do same.

If you own a towing business you are about to be regulated and here is what you need to know!

The towing industry is under scrutiny and it looks like it’s about to undergo some major regulations. Even though the bill has not been passed as law if you own a towing truck business it might be worth your while to take note of the below.

Why is this industry under scrutiny?

According an article published by SANews, Gauteng MEC for Roads and Transport, Ismail Vadi, said he was planning on amending the Provincial Road Traffic Act in a bid to regulate the towing industry in the province. This comes after many complaints received by the MEC’s office which include allegations of tow trucks operators bribing police officers to get first notification on an accident occurrence, recommending panel beaters who pay commission to towing personnel, reckless driving and charging excessive towing fees and failing to disclose the correct price before providing towing services to motorist.

The amendment to the Act will help to better govern the towing industry and promote professional business practices as the industry currently operates in an entirely unregulated environment and has come under scrutiny from the public.

What amendments can we expect?

Some of the amendments will include tow-truck operators having to carry cards issued by registering authorities which will state the tow truck operator’s trade name, type of business, postal and street address, contact details and an original tax clearance certificate.

Particulars of the tow truck operator and the driver will have to be printed on the Tow Truck Operator Card. These include the full name, identity number, photograph of the person and contact details.

The amended proposed Bill will also provide for the MEC to create prescribe requirements to be followed by the operator of a tow truck on a public road. These will also include an enabling mechanism for the appointment of an inspectorate of breakdown vehicle operators which is currently the function of the Gauteng Traffic Police Department.

The new policy will ultimately regulate the tow truck industry, promote road traffic safety and support economic growth and development of this transport sub-sector.

Conclusion

The drafting of the bill is almost done but has not yet been promulgated. Until such time as this bill is made law the onus is on the individual to keep vigilant when dealing with tow truck operators and tow truck operating businesses need follow the progression of this bill as it may have major effects to their businesses.

Tips:

- Although there is no specific tribunal or ombudsman that is specifically created to deal with the tow trucking industry, consumers may still refer their complaints against tow truck operators to the Consumer Commission Offices located country wide. As an owner it might be worth your while to discuss the consequences of such a complaint with your legal services provider.

Polygraph Test at Work – Is It Legal?

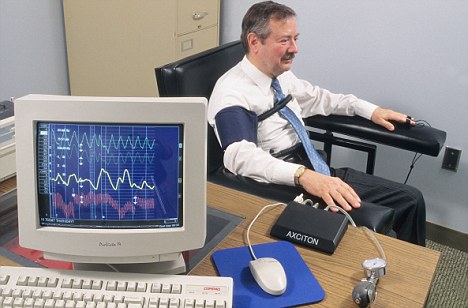

Can an employer compel an employee to take a polygraph test?

Most people understand that commercial information in the work environment is confidential but what happens if there is a breach of trust and company information is shared with the wrong people or worse if an employee uses it to cause harm to the business, can the employer force employees to take a polygraph test to find and dismiss the culprit.

What is a polygraph test?

According to Labor guide, it is a test used to verify a person’s truthfulness and is often called a ‘Lie Detector Test.’

What does the law say about this?

There is currently no law regulating this in South Africa .The general principle is that it is against the Constitution of South Africa to compel a person to undergo a polygraph examination, unless she or he consents to it. The consent must be in writing.

- The individual should be informed that—

- the examinations are voluntary;

- only questions discussed prior to the examination will be used;

- he/she has a right to have an interpreter, if necessary;

- should he/she prefer, another person may be present during the examination,

- provided that person does not interfere in any way with the proceedings;

So when can an employer use a polygraph test?

Generally, employers are permitted to use the polygraph to investigate specific incidents where—

- Employees had access to the property or information which is the subject of the investigation;

- There is a reasonable suspicion that the employee was involved in the incident;

- There has been economic loss or injury to the employer’s business like theft of company property;

- The employer is combating dishonesty in positions of trust;

- The employer is combating serious alcohol, illegal drugs or narcotics abuse and fraudulent behavior within the company;

- The employer is combating deliberate falsification of documents and lies regarding true identity of the people involved.

Can an employee be dismissed from the result of a polygraph test?

The courts have confirmed that the results of polygraph tests alone are not enough to justify an employee’s dismissal. There should at least be other circumstantial evidence to confirm the polygraph test result before a person can be dismissed. If an employer forces you to have a polygraph test you can object speak to your legal provider about how.

*Adapted from material from labourguide .

Terminating a Non-Performing Employee – What You Need To Know

Before you terminate a non-performing employee, here is what you need to know

Contrary to popular belief, firing a non-performing employee is stressful for all parties involved, not just the employee being fired. Before you send them packing, you need to ensure you’re taking the right steps to fire your employee. Get it wrong and you could cause an uncomfortable situation for both you and your employee, or worse still, legal issues that could have a major effect on the business. So before you call them into your office and give them the bad news, here is what you need to know.

What does the law say?

The Labour Relations Act 66 of 1995 (LRA) requires that the termination of employment must be fair (which requires the employer to prove that there is a fair reason for the termination and to follow a fair termination procedure).

What would constitute fair procedure before terminating an employee?

- You need to inform your employee ahead of time if you think that you need to let them go. It’s your responsibility as an employer to let them know that you feel they are underperforming.

- Highlight the fact that they have been underperforming and assert the consequences in the form of a warning, make sure you reiterate the consequences that may result should they continue to perform poorly in the future.

- If after all the meetings and the warnings your employee still doesn’t deliver, it’s time to have “the talk”. In this final meeting, have someone from HR or another employee other than yourself to sit in on the meeting and explain to the employee that you have come to a conclusion and that it’s irreversible.

- Talk to your employee about important matters such as their right to take the matter to the CCMA if they feel that the dismissal was not fair, the pension fund benefit, salary etc.

Why must you follow this long process, you’re the employer and you can do as you please, right?

Wrong! Sooner or later the labor law catches up with employers who fail to follow proper procedure. Section 188 of the LRA places the onus of proving that the dismissal was procedurally and substantively correct on the employer. The Labor Courts and the CCMA are intolerant of employers who cannot justify their dismissal. This could prove to be a very expensive exercise. Ask a legal professional or your legal insurance provider to assist you with drafting of a disciplinary and/or termination policy for your business.

Tips:

- Clearly set out the required standard of performance from the onset.

- Put the right resources in place to enable the employee to do their job as required

- If the failure by an employee to meet a performance standard is for reasons beyond the employee’s control, dismissal would not be justified.

- Create a paper trail of all communications to the employee about the fact that they are under performing

How to approach an ombudsman complaint as a small business

So you have received a complaint from the ombudsman’s office for services rendered to a client and your first reaction is to go into panic. Before you do let’s try and make you understand what an ombudsman’s complaint is, what impact it has on your business, what you can do as a business to try and resolve such complaints.

Who is the ombudsman and why must you entertain them?

Well the answer to this is very simple, the Ombudsman is an official appointed to investigate individual’s complaints against a company or an organization. Their role is to facilitate informal conflict resolution by providing advice, suasion, mediation, to follow up with actions and referrals.

The reason why you need to entertain them is also very simple, the Consumer Goods and Services Ombudsman (i.e. CGSO) is accredited as the official “alternative dispute resolution scheme” under the Consumer Protection Act (CPA).

With regard to complaints, the CGSO is authorized only to mediate between the parties. The CGSO has no powers to compel a supplier/ business to comply with a ruling, but can refer a matter to the National Consumer Commission, which can take it to the tribunal, which has powers to impose hefty administrative fines.

So I received this complaint what is my next move?

As a small business you need to establish a complaint’s process (this is required by the law) which may include:

- Choosing a staff member to accept all complaints and keep a roster,

- Establishing what the complaint is about and what it would take to resolve the issue with the complainant (i.e. the CPA gives consumers three options that is, refund, repair or a replacement ),

- The business also needs to also keep a record of all their interactions with the complainant prior to the referral of the complaint.

It needs noting that the complainant can only refer a matter to the CGSO after the complainant has brought her complaint to the attention of the business owner and the parties have not come to an amicable solution. Before business can employ delay tactics of not providing a response hoping the matter goes away, the code requires businesses to inform complainants of their right to escalate a complaint to the CGSO if not resolved by the business within 15 business days.

What are the consequences of ignoring a complaint?

Apart from the hefty administrative fine as mentioned above, the owner also risks reputational damage which may easily occur in the age of social media.

Tips:

- Acquaint yourself as a business with the code of CGSO alternatively speak to your legal provider

- The law now requires that all businesses, subject to a few exceptions, register and co-operate with the CGSO

- Failure to co-operate may be an aggravating factor when your matter is referred to the National Consumer Tribunal.

- Remember it takes a lot more effort and expense to gain a new customer than it does to keep an existing one

DEREGISTERING YOUR BUSINESS

So you have a business that isn’t working out and feel the need to deregister it, here is what you need to know.

How do I close down my business?

A business can only be closed down in two ways either by

- deregistration – according to CIPC, A business can be referred for deregistration upon request from the company or close corporation or any other third party, provided that the company or close corporation has ceased to carry on business; and has no assets or, because of the inadequacy of its assets, there is no reasonable probability of the company or close corporation being liquidated.

- Liquidation – according to the CIPC Liquidation implies that the business is not able to pay its debts.

Deregistration

To deregister a company there are 3 steps to follow:

- Write a letter to CIPC

The letter must include the following statement confirming that:

-

- The company or close corporation is not carrying on business or is dormant; and

- Has no assets, or because of the inadequacy of its assets, that there is no reasonable probability of the close corporation being liquidated

- the letter must be signed by each active member of the business

- Tax number.

- Prepare supporting information

- Tax clearance certificate

- Certified ID copy of any of the persons signing the letter wherein deregistration is requested;

- If a third party is applying for the deregistration, documentary proof must be submitted confirming the statement that the company or close corporation is not carrying on business or is dormant and has no assets

- Scan and email the letter and attachments to deregistration@cipc.gov.za

According to Lebogang Tsele of SME South Africa (16 May 2016 publication) there are a few other factors that need considered before completely closing down:

- your employees

The employees are usually the worst affected by the shutting down of a business, it is therefore important for the business owner to handle employee-related issues with care. This includes ensuring that employee benefits such as retirement annuities and medical aids are dealt with adequately.

- contractual obligations

Contracts should not be neglected when the company closes down. Unfulfilled contractual agreements can easily come back to haunt you.

- take care of director and shareholder liability

Deregistration of the company does not affect the liability of any former director or shareholder of the deregistered company in respect of any act or omission that took place before deregistration. These liabilities will continue and may be enforced as though the company had not been deregistered

- Taxes

Once a business receives confirmation from the CIPC that it has been deregistered, the registered representative should visit their nearest SARS branch and make sure the business is deregistered for all the various types of tax.

Disclaimer: this is general advice and should be relied upon solely, consult a professional before proceeding with the deregistration of your business

Legal Protection For Your Business

When it comes to legal advice and business support, legal services from a professional legal team is something that you simply cannot be without. Whether you need assistance with your debt collection efforts, or legal advice when signing agreements, a team of qualified attorneys is the ideal solution to protect your business. The unfortunate thing is that small businesses cannot afford to retain an entire legal army.

Another way to upkeep protection for your business is to ensure that all contracts entered into will not harm your business.

According to Monisha Prem, in an article published by SME, a written contract is the best way to protect a business relationship. It outlines the terms of the agreement in plain black and white so that there’s no confusion and no misunderstandings.

There are 3 basic types of contracts that are important in a business namely: Constitutional contract, Relational contract and Transactional contract.

Constitutional Contract

The most important document in the constitution of a company is the Memorandum of Association of the company. The Articles of Association is the second most important document that needs to be registered by any company for its incorporation, registration and subsequent operation. These contracts are signed by the members of the company and lay down the rules for the internal management of the company.

Relational Contracts

A relational contract is a contract whose effect is based upon a relationship of trust between the parties to which it pertains. These contracts establish and manage rights and obligations between various business parties such as suppliers, customers and employees. An example of this type of contract would be a contract of sale, an employment contract, negotiable instruments etc.

Transactional Contracts

These contracts regulate commercial transactions such as purchase and sale of assets or shares, or raising debt or equity. These contracts may include clause referring to what will be exchanged, when the delivery and inspection will occur, how delivery will be made and may include other additional matters such as guarantee, liability and confidentiality. An example of this type of contract would be a non-disclosure agreement.

What do business owners need to be aware of before signing a contract?

- Does the other party have the capacity (ability) to enter into the agreement and are they authorized to enter into this kind of agreement

- Are there any specific laws that apply: such as those regulating the selling or buying of land or dealing with long leases or ante-nuptial contracts?

- Does the contract have any illegal element that is contrary to any law or society, if so the agreement cannot be enforced

- Ensure that the obligations for each party are possible to be performed.

- Understand clearly how to terminate or exit the contract and under what circumstances you are entitled to do so, such as material breach.

- Be aware of significant dates or events that apply to each party the consequences of not complying.

Tips:

- Do not enter or sign any agreements that you do not fully understand

- Ensure that the contract is well prepared .This will protect each of the parties’ business interest

- Ensure that each party’s rights and responsibilities are clearly set out and are well understood.

Public Liability Claims

In this article we focus on public liability insurance and the claims that arise as a result there of. First things first what is public liability and what public insurance is. Public liability insurance is designed for professionals who interact with customers or members of the public? It protects against claims of personal injury or property damage that a third party suffers (or claims to have suffered) as a result of your business activities. Public liability may also arise as a result of government’s failure to fulfill its statutory obligations. Private Companies may also be liable for failure to adhere to specific legislations such as the Consumer protection Act. Since the enactment of the Consumer Protection Act (2011), consumers seeking compensation for damages caused by goods, are no longer required to prove that producer of the goods was negligent, only that the goods were purchased and that harm resulted from using them.

Types of public liability

According to “claimhelp.co.za” the below may be seen as types of public liability:

- General and tenant insurance covers cases in which damage to a member of the public occurs to a member of the public e.g. If an air conditioner mounted outside of the building falls and crashes onto a car, or if the tenant or member of a gym, slips on the way to the pool.

- Employer’s liability discharges the responsibility of the employer from the injury or damage done to an employee or their assets as a result of negligence on the part of the business. e.g. If a pipe bursts in the office and spills dirty water all over the desks of your employees, liability insurance will cover the employer for injuries suffered and damages to the employees’ phones, clothes, computers etc.

- Product liability protects businesses from damages caused by goods to customers, and also from products arriving in a damaged state, and wrong delivery.

- Contractor’s liability provides protection against damages and injuries to third parties resulting from construction and maintenance work.

- Professional indemnity protects professionals from loss/injury/damage to third parties due to erroneous advice or treatment, this would typically be in relation to lawyers etc

Types of claims

- Small and frequent claims that usually involve smaller compensatory amounts.

These are often due to simple negligence on behalf of the accused

g. unkempt walkways, potholes, objects falling off of construction sites. - Large but rare claims involving exceptional sums and severe injuries. Generally occur due to failure on the part of the business to protect the person from injury.

Who needs Public Liability Insurance?

According to Galileo Risk Insurance, almost all businesses should have some form of Public Liability Insurance. Any business can potentially damage people or property. All businesses are bound by a duty of care for their clients, suppliers, distributors, neighbors & the environment. In today’s litigious society, companies are being held more & more responsible for injuries or damages they cause to their surroundings or to other people.

Public liability Insurance

The unfortunate thing is that no business is immune from accidents even with the best laid plans. Even if your company has not been negligent, the legal costs incurred in defending your company could cripple a business if not insured against. It needs no emphasis how important public liability insurance is to a business. The typical examples of claims are the following

- Small frequent claims include client’s vehicles being damaged by unkempt parking areas, items falling off of buildings hitting nearby cars or other buildings, gates closing on third party vehicles, general lack of maintenance which causes damages to the surrounding areas & so forth.

- The rarer but crippling claims occur when third party people are injured because a company failed to protect them. We have also had huge claims where entire hotels or townhouse complexes had to be evacuated & repaired because of accidents made by businesses, the claim was therefore not only for the repairs but also for providing accommodation of a similar nature to all the distressed occupants

Tip:

- There are certain professions that are obligated to take out public liability Insurance such as attorneys , if you find yourself having a claim against them speak to their fund first that may eliminate a lot of “cat and mouse “chase in the event that they do not want to compensate you for damages incurred whether general or special damages .

- If you are a business owner public it may be a good idea to take our public liability insurance, the courts are inclined to favor the consumer or the claimant because they are afforded such great protection by the Consumer Protection Act . The perk is it does not cost a lot of money and because most insurance companies offer this kind of cover you can compare quotes.

Tax Guidelines for your New Business

Before opening up or starting your business you need to establish what kind of business entity would best suite your business. There are generally three (3) options, that is:

- A sole proprietorship also known as a sole trader is a type of business entity which is owned and run by one individual and where there is no legal distinction between the owner and the business. This entity does not enjoy separate personality and as a result does not have to be registered as a tax payer.

- A partnership is also not a separate legal person or taxpayer. Each partner is taxed on his or her share of the partnership profits.

- A private company is treated by law as a separate legal entity and must also register as a taxpayer in its own right. This means that private companies bear their own obligations and duties related to tax. It needs to be noted that Close Corporations (CC) also fall under this category since the coming into operation of the new Companies Act , CC can no longer be registered with the Registrar of Companies .

How do I register for Tax?

Before a private company can be registered for tax it needs to be registered with the Registrar of Companies. A private company needs to be registered within 60 days after having commenced business by completing an IT77 form (available from your local SARS office or their website). After registration the CC or private company will then be registered automatically as a taxpayer. There are also further registrations that may apply depending on how much turnover a company makes and whether the company has employees such as VAT, PAYE, and Customs, Excise, SDL and UIF contributions.

What kind of tax am I supposed to pay?

- Provisional tax

Provisional tax is a method of paying tax due, to ensure the taxpayer does not pay large amounts on assessment, as the tax liability is spread over the relevant year of assessment. It requires the taxpayers to pay at least two amounts in advance, during the year of assessment, which are based on estimated taxable income.

As soon as you commence business you will become a provisional taxpayer and will be required to register with your local SARS office as a provisional taxpayer within 30 days after the date you become a provisional taxpayer.

The first provisional tax payment must be made within six months after the commencement of the tax year and the second payment not later than the last day of the tax year.

- Employee tax

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their staff. Payroll taxes generally fall into two categories: deductions from an employee’s wages, and taxes paid by the employer based on the employee’s wages. This is paid on a monthly basis.

A business (an employer) that pays salaries, wages and other remuneration to any of its employees above the tax thresholds, must register with SARS for employees’ tax purposes. Registration of same is done by completing the EMP 101 form and submitting it to SARS.

How much tax do I have to pay?

A sole proprietor or each partner in the case of a partnership is subject to income tax on his or her taxable income. Income tax (normal tax) is levied at progressive rates ranging from 18% to 40%. Unlike individuals, a company or CC pays 28% income tax on its taxable income for the tax year and 10% secondary tax on companies (STC) on the net amount of dividends declared.

Tips:

- Always consult a tax professional regarding all your tax matters.

- Keep all your records (save all related documents)

- Pay your taxes ( like Benjamin Franklin said “ there are only two things that are certain in life that is death and taxes)

Employement by a small business on a fixed term contract?

The question that all small business owners will have at some or other point during the existence of their business is whether as an owner/employer, they can employ more people and whether they are obligated by law to give such people permanent employment.

What happens if you have a person that comes in on a part time basis to assist with admin, are they an employee by law, further what happens if you agree to a fixed term contract?

In terms of S 200 A of the Labor Relations Act and Section 83 A of the Basic Conditions of Employment Act you are presumed to be employees if:

- The manner in which a person works is subject to your control

- The person works for an average of 40 hours per month over a period of 3 months

- The person is a economically dependent on you

- The person renders services to one person

- You as the employer provide the employee with the tools to perform their duties

The question that then arises is whether a small business can employ on a fixed term contract?

A fixed term contract means a contract of employment that terminates on the occurrence of specific event, the completion of a specific task or project. The simple answer to the question above is yes; the LRA affords employees added protection. This is how:

- What protection are you afforded?

Fixed term employment contracts with lower earning employees are now limited to a 3 month period. After 3 months, the employee will be deemed to be an indefinite employee and will therefore be protected against things like unfair dismissal and will have to be registered with the Department of Labor for UIF benefits.

- What is meant by lower earning?

The LRA has set a threshold of R 205, 433.20 or less per annum what this means is that employees that earn more than the mentioned amount are not afforded the protection relating to fixed term contracts.

- What employers are exempted from the above?

Employers should take note of the fact that the above does not apply to employers that have less than 10 employees or to an employer that employs less than 50 employees and has only been in operation for less than 2 years.

- Requirements for renewal

It is now a requirement that renewal contracts should be writing and the reason for renewal should be stated as well as reasons why the employer chooses to fix the term. The onus is on the employer to prove why they chose to enter into a fixed term contract.

It is always justifiable to to enter into a fixed term contract if

- The nature of work is so limited or is definite in duration.

- The employer can demonstrate a reason for instance if the employee is a recent graduate and the objective of the employment is to gain experience.